FERC Order 2023 has brought sweeping changes to power markets across the U.S., and New York is no exception. NYISO’s first-ever cluster study, concluded on November 15th, 2024, accepted 30.9 GW of Battery Energy Storage System (BESS) applications—a monumental step toward achieving Governor Hochul’s vision of modernizing New York’s power grid for the future.

This article, Part 1 of a two-part series, provides an overview of the results and explores their implications for the wholesale power markets.

Zooming Out: Digesting the Results

What Happened?

NYISO’s 2024 Cluster Study marked a major step in energy storage development. Governor Hochul’s legislated target of 6 GW by 2030 has spurred significant interest, with 30.9 GW of BESS applications submitted—over five times the target. It remains to be seen what percentage of these projects will withdraw or successfully reach COD by 2027–2028.

Meanwhile, NYSERDA’s Bulk Energy Storage Incentive Program, launching in 2025, will use the Index Storage Credit (ISC) mechanism to contract 3 GW of BESS over three years (1 GW annually). With 30.9 GW already in the NYISO queue, the key question is: what opportunities remain beyond this program, and how will the market evolve once credits are allocated?

Could bilateral Contracts for Difference (CfDs) with LSEs and large energy buyers provide an alternative pathway for revenue certainty and market growth beyond NYSERDA’s program?

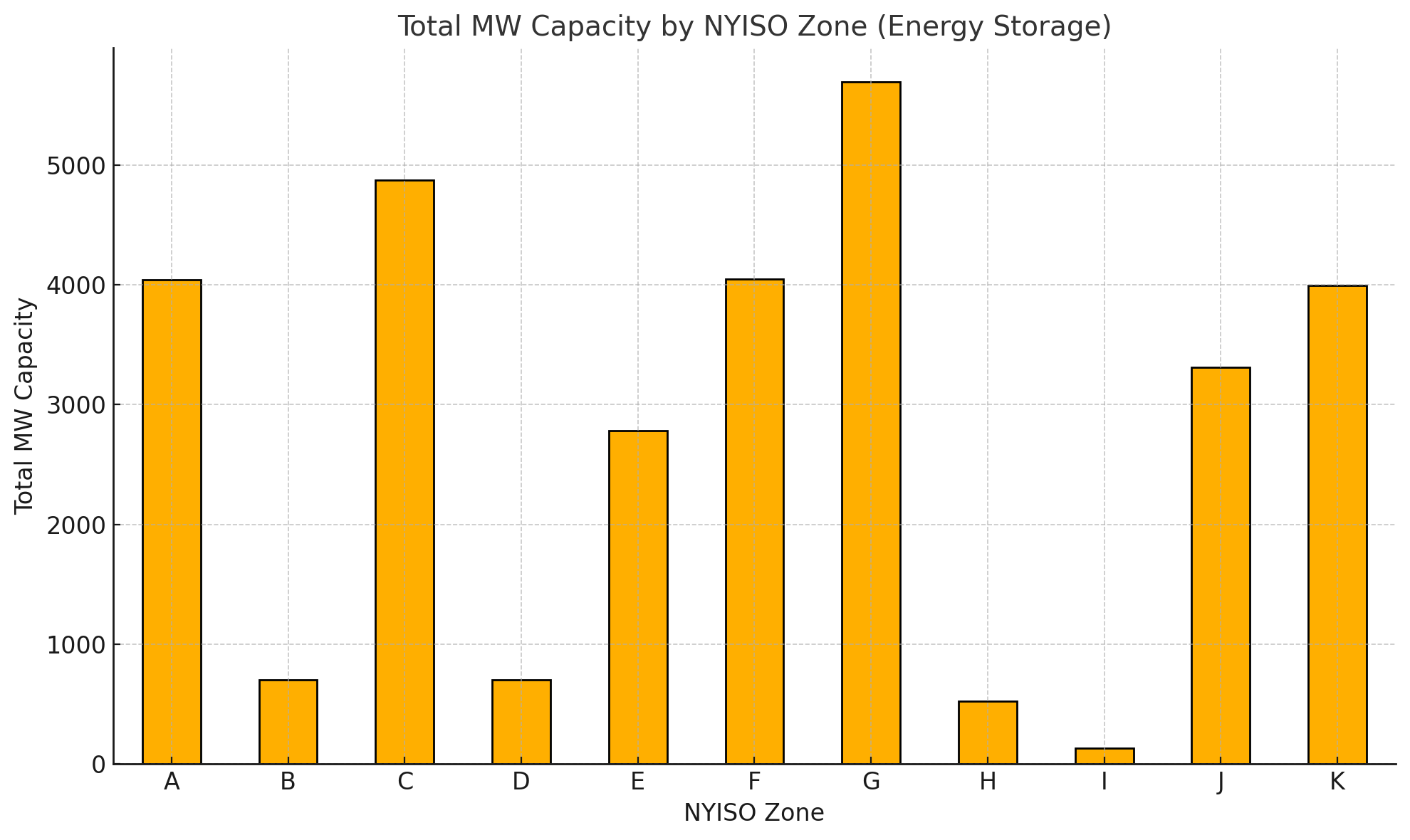

NYISO BESS Capacity by Zone

The 30.9 GW of accepted BESS applications is distributed across NYISO zones as follows:

- Zone G (Hudson Valley): 5,695 MW

- Zone C (Central NY): 4,871 MW

- Zone F (Capital): 4,049 MW

- Zone A (West): 4,038 MW

- Zone K (Long Island): 3,996 MW

- Zone J (NYC): 3,309 MW

- Zone E (Mohawk Valley): 2,779 MW

- Zone D (North): 705 MW

- Zone B (Genesee): 700 MW

- Zone H (Millwood): 524 MW

- Zone I (Dunwoodie): 130 MW

Observation: Zone G (Hudson Valley) leads with 5,695 MW, followed by Zones C and F. Strategic renewable integration drives this concentration.

Explore Market Trends on the Map

Leverage The Map as a resource to explore NYISO zones and gain deeper insights into the market. This tool provides valuable intelligence on regional capacity trends and infrastructure opportunities.

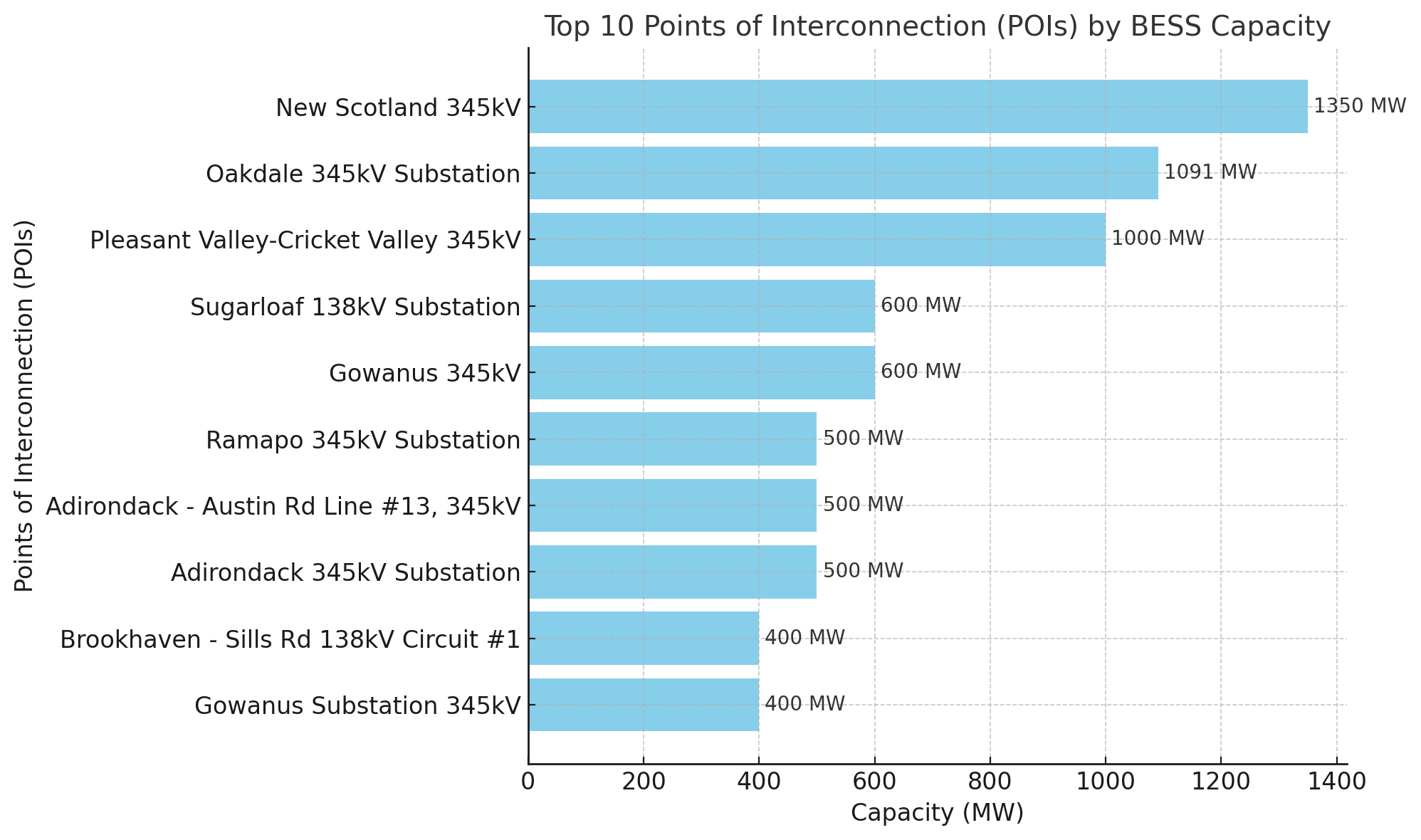

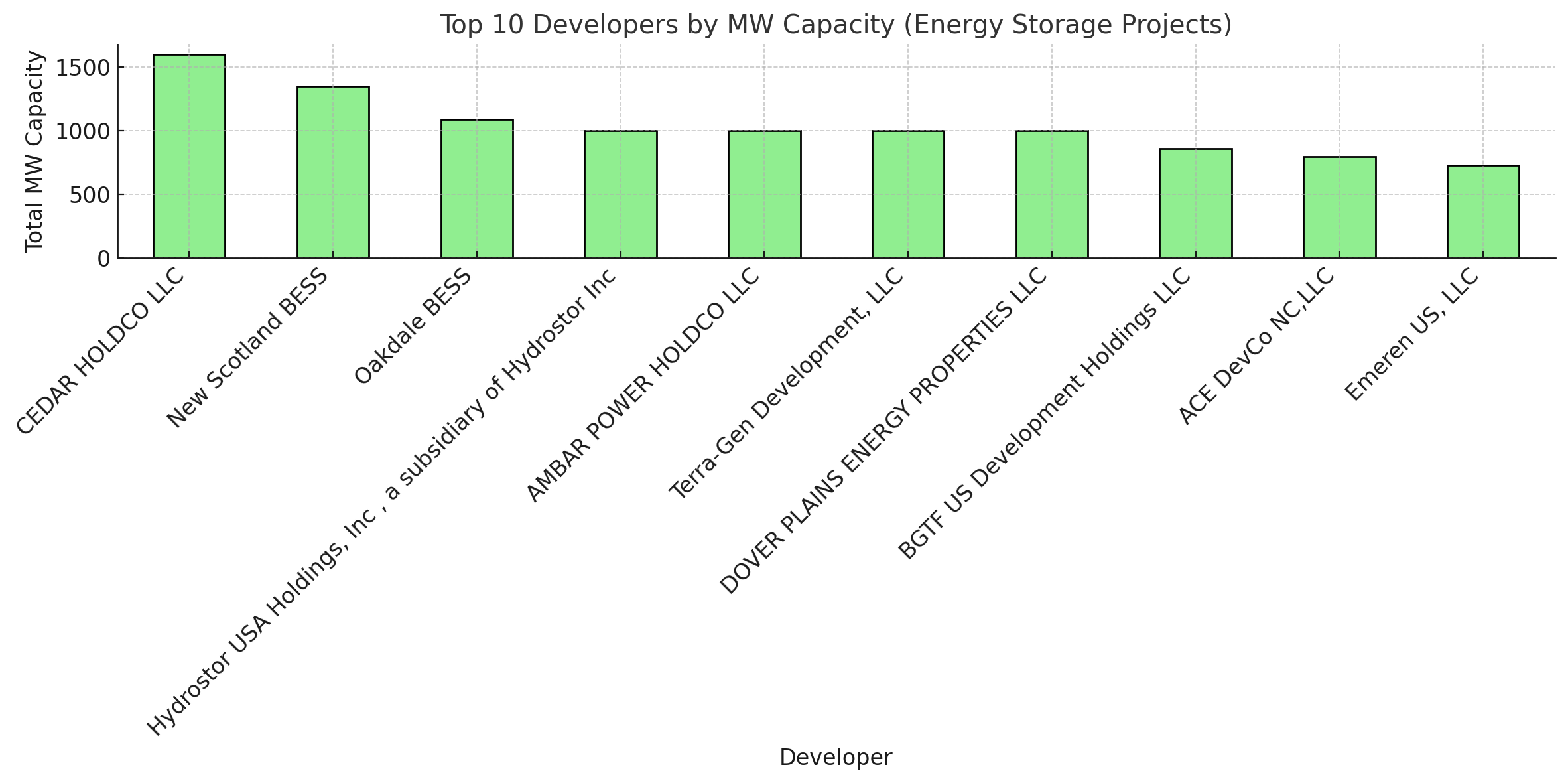

Top 10 Points of Interconnection (POIs)

The leading Points of Interconnection (POIs) by BESS capacity:

- New Scotland 345kV: 1,350 MW

- Oakdale 345kV Substation: 1,091 MW

- Pleasant Valley-Cricket Valley 345kV: 1,000 MW

- Sugarloaf 138kV Substation: 600 MW

- Gowanus 345kV: 600 MW

- Ramapo 345kV Substation: 500 MW

- Adirondack - Austin Road Line #13, 345kV: 500 MW

- Adirondack 345kV Substation: 500 MW

- Brookhaven - Sills Rd 138kV Circuit #1: 400 MW

- Gowanus Substation 345kV: 400 MW

Observation: High-voltage POIs like New Scotland and Oakdale dominate, reflecting their strategic importance for transmission and renewable integration.

Use The Map for Market Insights

Discover how infrastructure like POIs aligns with capacity trends using The Map. It’s a powerful tool to analyze opportunities and regional strengths.

What’s Next? Key Questions for Part 2

Cluster Study Timeline Impacts

-

COD Timelines:

- The 2024 Cluster Study projects will COD by 2027–2028, while 2027 Cluster Study entries will COD by 2030–2032.

- The interim gap will tighten supply and drive market volatility, favoring first movers.

-

Attrition Factors:

- How many projects will withdraw after the Customer Engagement Window or Cluster Study Withdraw Periods?

- What factors—such as interconnection costs, transmission delays, or regulatory hurdles—will drive attrition?

Market Saturation or Leadership?

- Does the queue size indicate market saturation, or is New York emerging as a leader in utility-scale BESS?

- How will delays in offshore wind projects impact BESS development and the wholesale market?

Developer Strategies

Utilize The Map to assess how market trends and infrastructure influence development strategies in NYISO’s evolving grid.

- Are developers using "foot-in-the-door" tactics to secure grid access and expand later?

Future of NYSERDA’s Indexed Storage Credit Program

- Will NYSERDA expand the program to meet the overwhelming demand?

- How does the program’s CfD-backed structure enable traditional project financing compared to merchant BESS models?

The Future Beyond Indexed Storage

- As battery costs decline, will we see a shift from long-duration systems to shorter, more flexible BESS designs?

- Can New York’s energy demand sustain this level of BESS development?

Source Data:

Data derived from the NYISO Cluster Member List, published on 2024/12/02, detailing MW capacities, POIs, and zones from the 2024 Cluster Study.

Stay Tuned

Follow us for insights on NYISO’s evolving energy storage market and updates on NYSERDA’s Indexed Storage Credit Program. Explore The Map to stay ahead of the market with actionable intelligence.