The majority of operating period term loans to United States solar projects are back-levered to tax equity investments. Given the prevalence of this financing structure, it is important that back-levered lenders understand the terms of the project’s tax equity investment and how these terms impact lender access to project cash flows, as well as their ability to foreclose.

Back Leverage

With regard to solar projects, ‘back leverage’ generally refers to debt financing which is provided by lenders to a holding company that owns a controlling interest in a tax equity partnership. This tax equity partnership, in turn, owns the project company which owns and operates the asset.

Tax Equity

Typically, solar projects in the United States are financed using tax equity investments. The term ‘tax equity’ refers to an equity investment in which the bank/investor invests in a solar project in a manner allowing that investor to benefit from the federal income tax credits generated by the solar project. While the investor benefits from the federal income tax credits, the developer and tax equity investor share the cash flows generated by the solar project. This financing structure is beneficial as it allows solar developers which may not be current U.S. taxpayers to monetize the tax benefits arising from the solar project.

Typical Back-Leverage Financing Structure

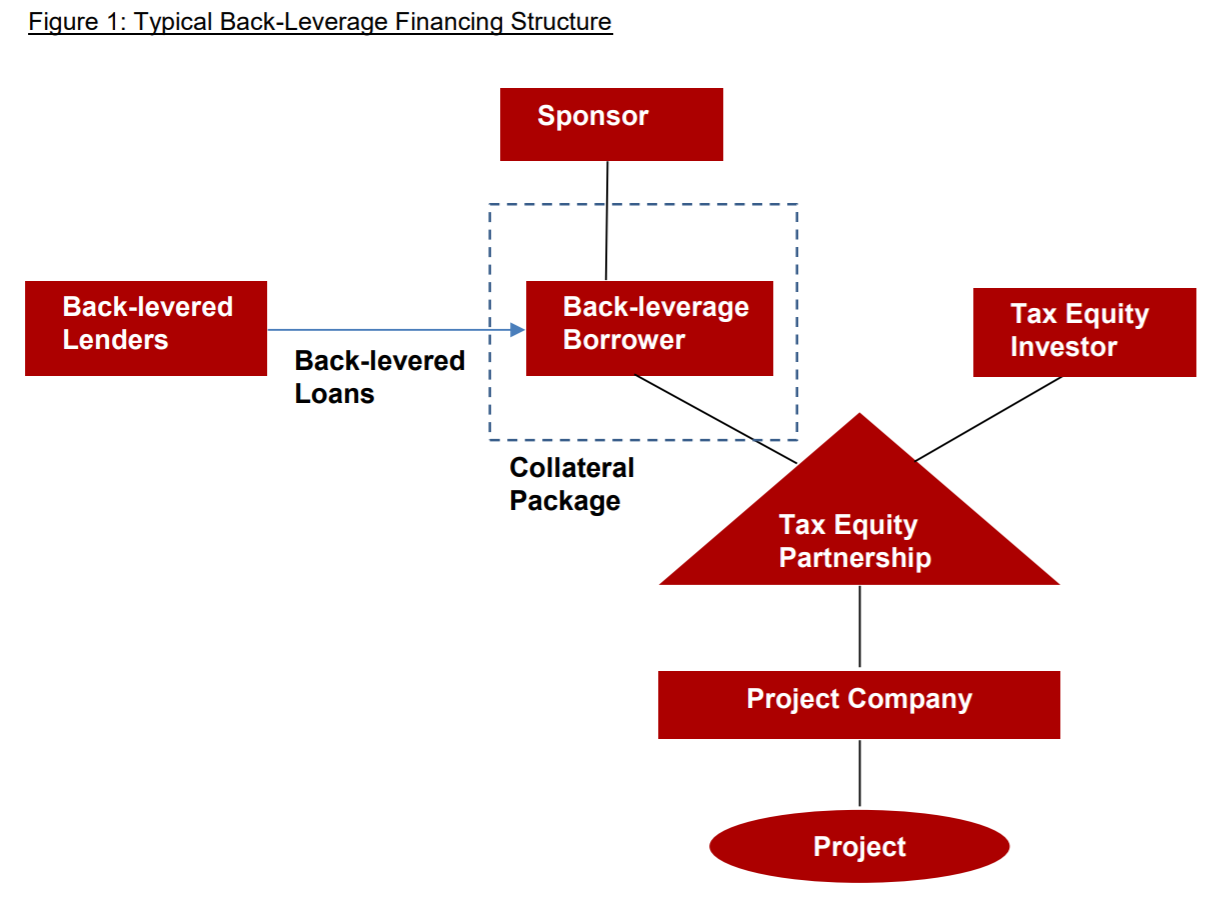

In a typical back-leverage financing structure, back-levered lenders enter into a credit agreement with, and make loans to, a holding company established by a sponsor. This holding company is set up by the sponsor in order to hold the sponsor’s equity interests in the tax equity partnership. The tax equity partnership, which is usually structured as a limited liability company, is part-owned by the holding company serving as the back-leverage borrower and part-owned by the tax equity investor. This partnership owns all equity interests in the project company, which itself owns and operates the solar PV project.

Within this financing structure, back-leverage financing is secured via a pledge of all assets of the back-leverage borrower. These assets generally consist of the sponsor’s equity interests in the tax equity partnership and one or more bank accounts. Additionally, back-leverage lenders receive a pledge of equity interests in the back-leverage borrower. Back-leverage lenders do not, however, receive security interests in assets of the tax equity partnership or project company. Thus, they do not have direct recourse to either.

The graphic below, courtesy of Latham & Watkins LLP, illustrates the typical back-leverage financing structure.

Key Considerations Relating to Ability to Foreclose

Generally speaking, tax equity documentation restricts the ability of both the sponsor and the tax equity investor to transfer their tax equity interests in the partnership without the consent of the other party. In some cases, however, there may be negotiated criteria for permitted transfers that do not require the consent of the other party. Negotiated criteria for permitted transfers may include requirements relating to:

- Transferee creditworthiness

- Experience of transferee in owning & operating similar assets, to ensure that there are no adverse effects on ability to qualify for tax credits

- Transferee not being in litigation with tax equity partnership/other members

- Know your customer & other compliance considerations

The restrictions outlined by tax equity documents typically apply to both direct transfers of equity interests and to indirect transfers and changes of control of a member. These restrictions are important for back-leverage lenders because they are usually triggered by foreclosure on equity interests in the tax equity partnership, or foreclosure on interests in the back-leverage borrower.

Certain transfer provisions may anticipate that back-levered financing will be incurred and, as a result, will make it possible for collateral agents to foreclose while satisfying a more limited set of criteria. Others, however, do not provide this level of flexibility. If the tax equity documents do not include such accommodations, then back-levered investors may seek to obtain them by including them in a consent to assignment with the tax equity investor.

Do you want to develop your own solar project? Whether it’s residential, commercial, or community, YSG Solar will identify the ideal project for your needs and make it a reality. To learn more, send us an email or call at 212.389.9215 today.

YSG Solar is a project development vehicle responsible for commoditizing energy infrastructure projects. We work with long-term owners and operators to provide clean energy assets with stable, predictable cash flows. YSG's market focus is distributed generation and utility-scale projects located within North America.

Sources:

Featured Photo by William Mead from Pexels.