We have seen huge growth for the solar industry over the past couple of decades, and the solar investment tax credit (ITC), sometimes referred to as the federal investment tax credit, is a big reason for this growth. According to the Solar Energy Industries Association (SEIA), the U.S. solar industry has grown by over 10,000% since the ITC was enacted in 2006. This staggering level of growth has created hundreds of thousands of jobs, stimulating the U.S. economy and contributing massively to the overall growth of renewable energy. The success of the ITC has been undeniable, and countless residential solar consumers have saved thousands of dollars thanks to the solar investment tax credit.

What is the Solar Investment Tax Credit?

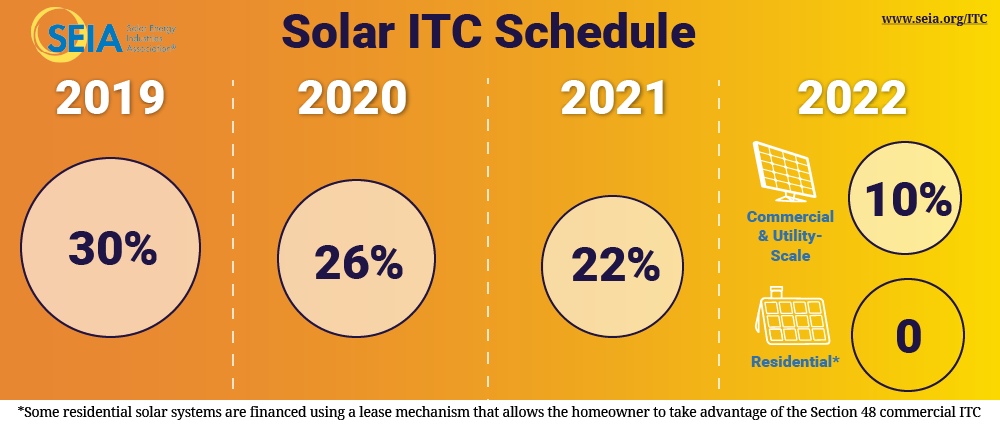

The solar investment tax credit (ITC) is a 26% tax credit for both residential and commercial solar systems. As noted above, the ITC has been hugely influential in the growth of the solar industry. Unfortunately, despite this success, the ITC has begun stepping down. Whereas the credit was 30% in 2019 and previous years, it is now down to 26% in 2020, and will drop further to 22% in 2021, before dropping to 10%—for commercial properties only—in 2022. This means that residential property owners interested in going solar don’t have much time left to take advantage of the ITC. The ITC was originally established as part of the Energy Policy Act of 2005, and set to expire in 2007, but its popularity and success has resulted in multiple extensions in the years since. The image below, courtesy of the Solar Energy Industries Association (SEIA), outlines the current and future status of the solar ITC.

Who is Eligible for the Solar Investment Tax Credit?

The solar ITC is available to residential and commercial customers who own their solar energy system. If you lease the solar system, or use a PPA, then you are not the owner of the solar system and, as a result, will not be able to claim the solar investment tax credit. If your tax liability is not large enough to claim the full value of the tax credit, then you may roll it over to following years as long as the ITC remains in effect. For residential solar consumers, this doesn’t leave much time, as the ITC steps down further to 22% next year before ending completely. From 2022 onwards, there will be a 10% credit available for commercial solar systems only.

How to Claim the Solar Investment Tax Credit

You can claim the solar investment tax credit when you are filing your yearly federal tax returns. If your tax liability isn’t a large enough amount to claim the entire value of the solar ITC, then you may roll the credit over to future years, as long as the ITC is still in effect. If you use an accountant to file your taxes, be sure to inform them that you have gone solar and are eligible for the solar ITC. In order to claim the ITC, you must meet certain requirements which establish that construction of a solar facility has begun. There are different criteria for residential and commercial projects respectively, and the IRS issued guidance regarding this in June 2018.

If you’re thinking of going solar, why wait? We’re nearly at the end of 2020 already, so you don’t have much time left to take advantage of the 26% solar tax credit before it declines to 22% next year. Get started today by speaking to YSG. Send us an email or call at 212.389.9215 to learn more.

YSG Solar is a project development vehicle responsible for commoditizing energy infrastructure projects. We work with long-term owners and operators to provide clean energy assets with stable, predictable cash flows. YSG's market focus is distributed generation and utility-scale projects located within North America.

Sources:

https://www.seia.org/initiatives/solar-investment-tax-credit-itc

https://www.energysage.com/solar/cost-benefit/solar-investment-tax-credit/